Using DeFi platforms like Compound

Contents:

Introduction

Create an Account on Compound

Connect Wallet

Borrow Any Asset

Transaction Confirmed

Repay and Withdrawal

Banking, budgeting, saving, credit, debt, and investing are the foundations that support the majority of our financial decisions. And having all the required basic knowledge of these things is a must.

Financial literacy is the ability to understand and make use of a variety of financial skills, including personal financial management, budgeting, and investing. It also means comprehending certain financial principles and concepts, such as the time value of money, compound interest, managing debt, and financial planning.

Through this blog, you will get to know about Compound, an online financial marketplace that will assist everyone to deal with lending, borrowing, and other financial services utilising cryptos.

Compound finance is a type of online financial marketplace that allows users to lend and borrow digital assets. Now let’s get started with compound by creating an account.

Follow the below steps: -

Visit the given link.

https://compound.finance/

Compound

The compound is an algorithmic, autonomous interest rate protocol built for developers, to unlock a universe of the open…

compound. finance

2. Connect your Meta mask/Ledger/Wallet Connect/Coinbase Wallet or Tally wallet by clicking the App Button in the upper right-hand corner.

Connect your Wallet

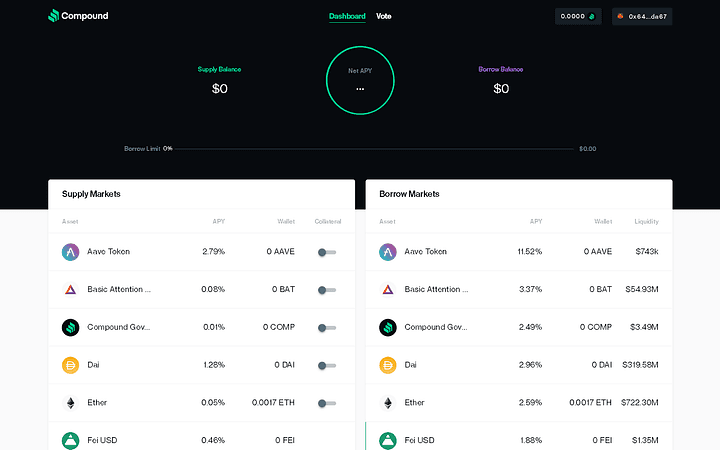

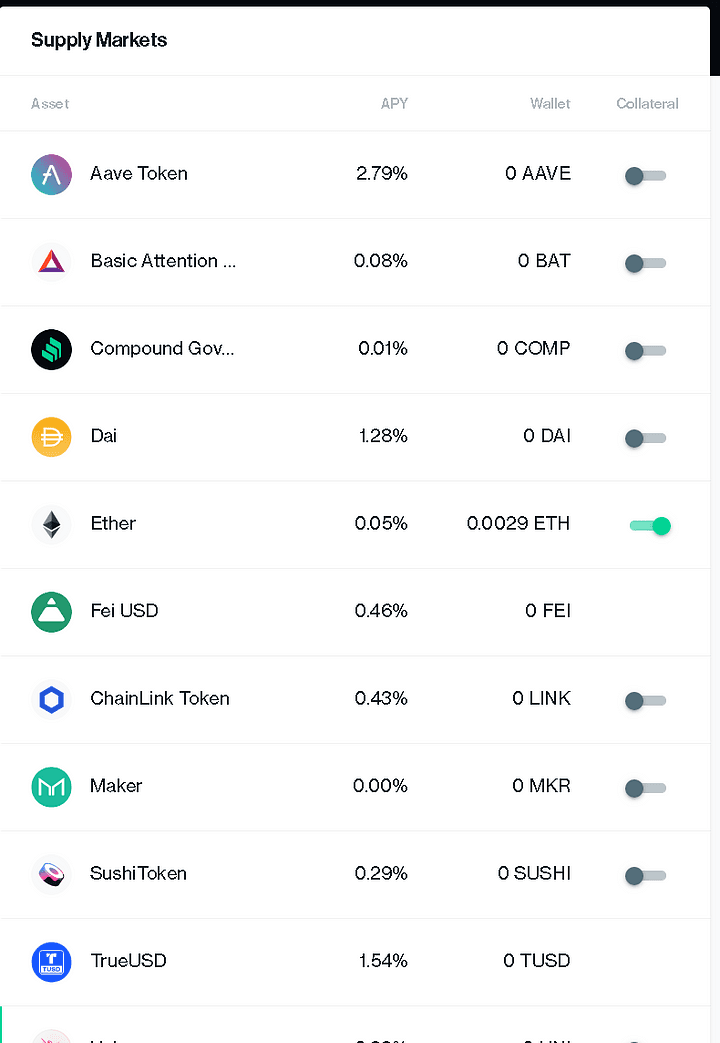

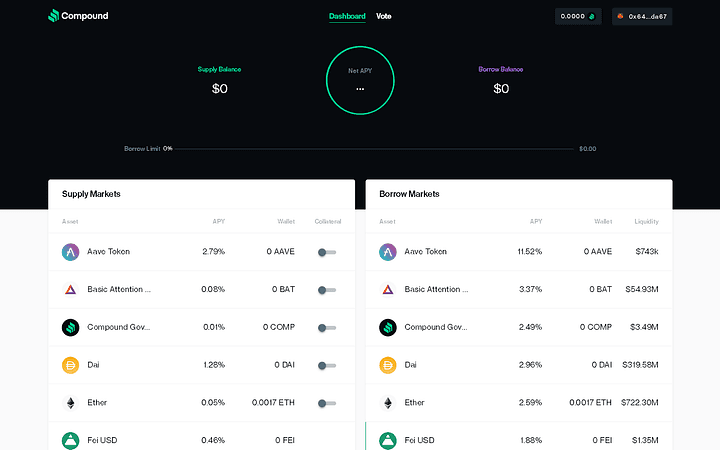

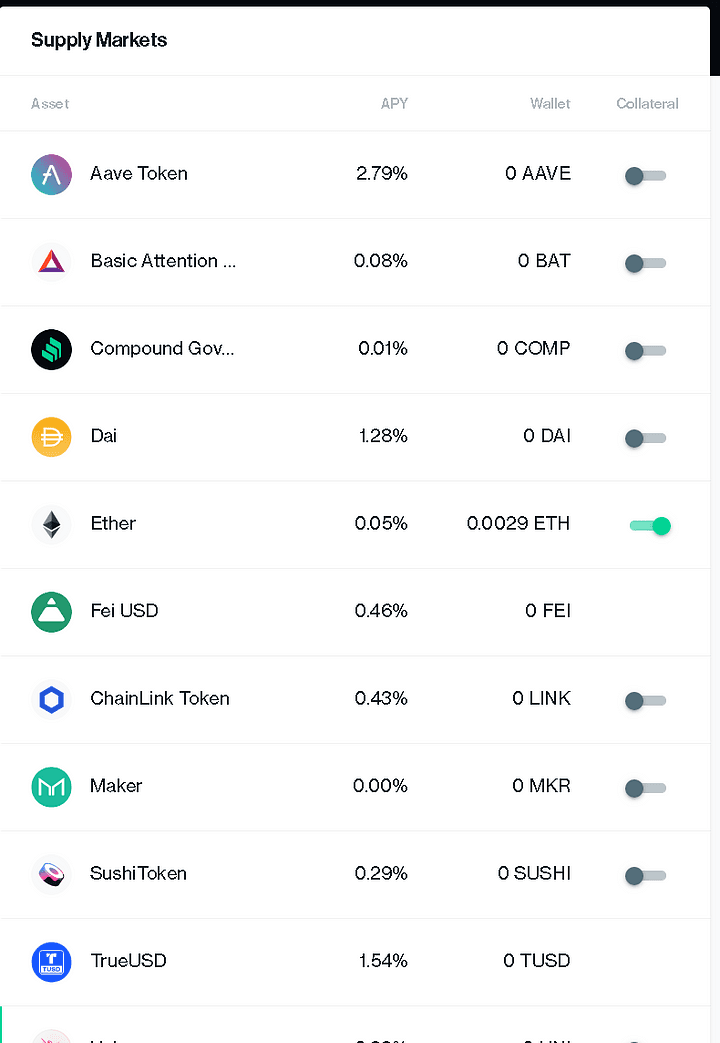

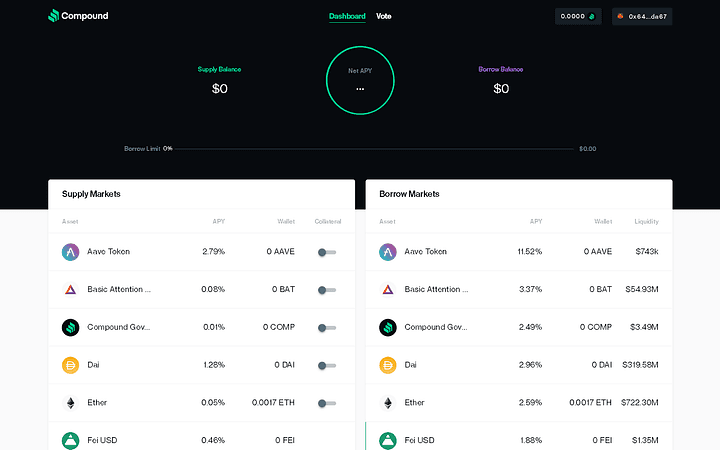

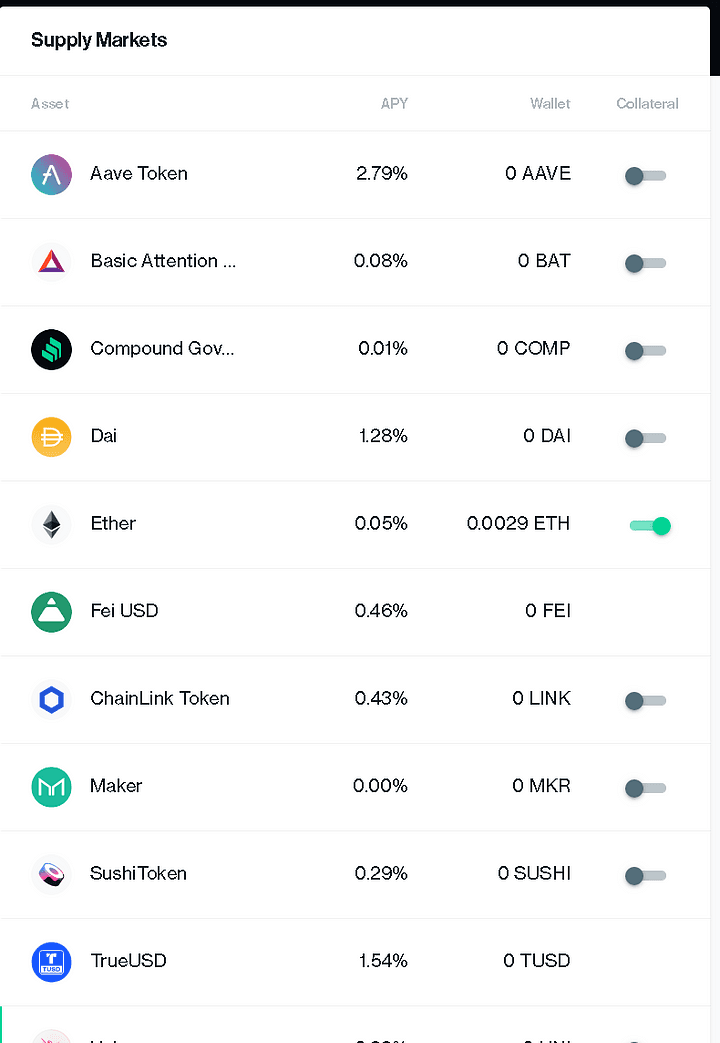

3. After connecting our Wallet, we may supply any Asset and receive interest on our given asset, which is represented by APY (Annual Percentage Yield). To provide any asset, we click on the desired asset and enter the amount we wish to supply.

Start Supplying Assets

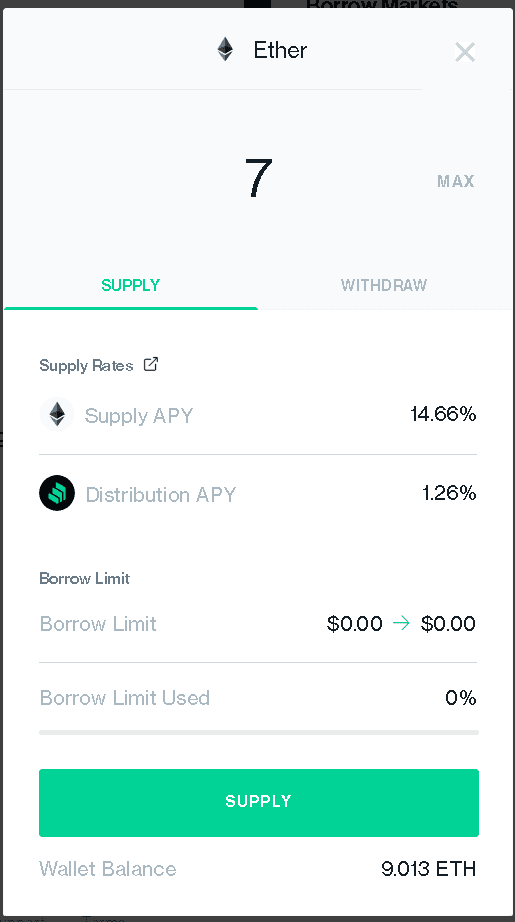

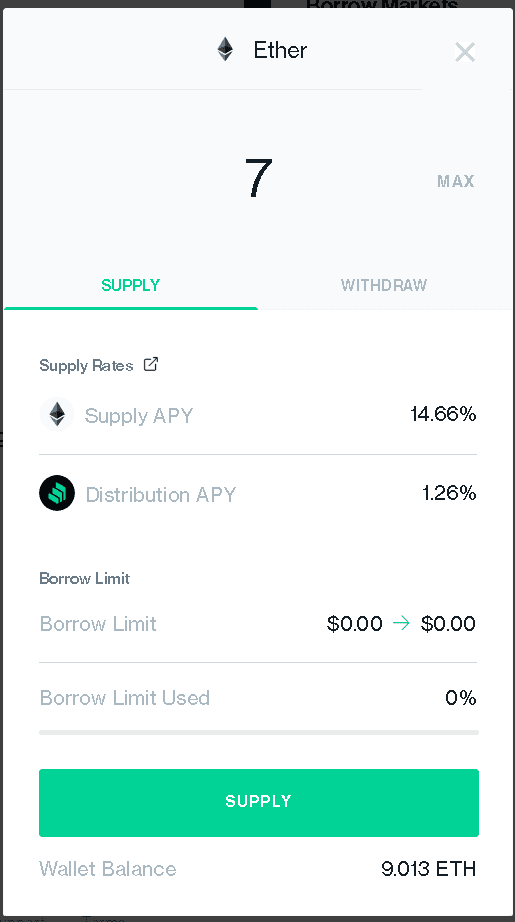

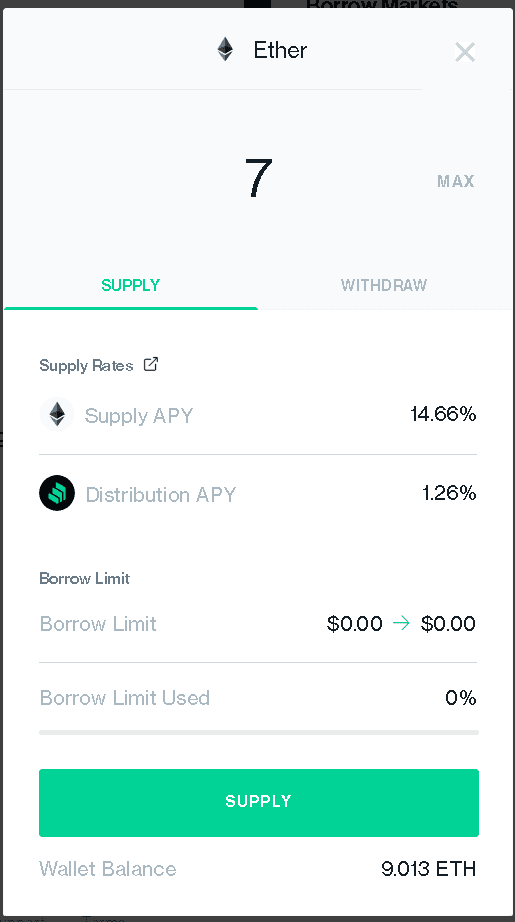

4. If I supply 7ETH here, you don’t need to worry about the Borrow Limit; simply enter the number of assets you want to supply and click the Supply button. This will send you to your wallet to confirm the transaction.

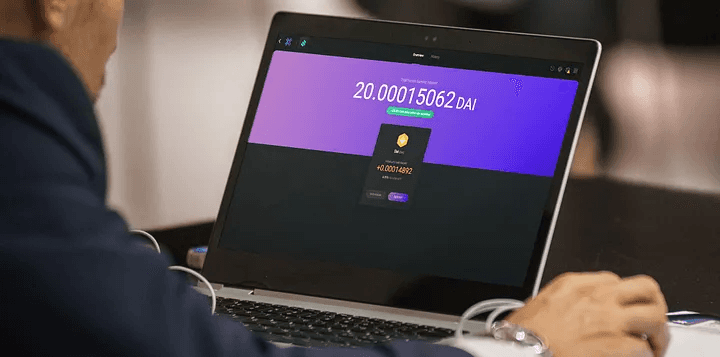

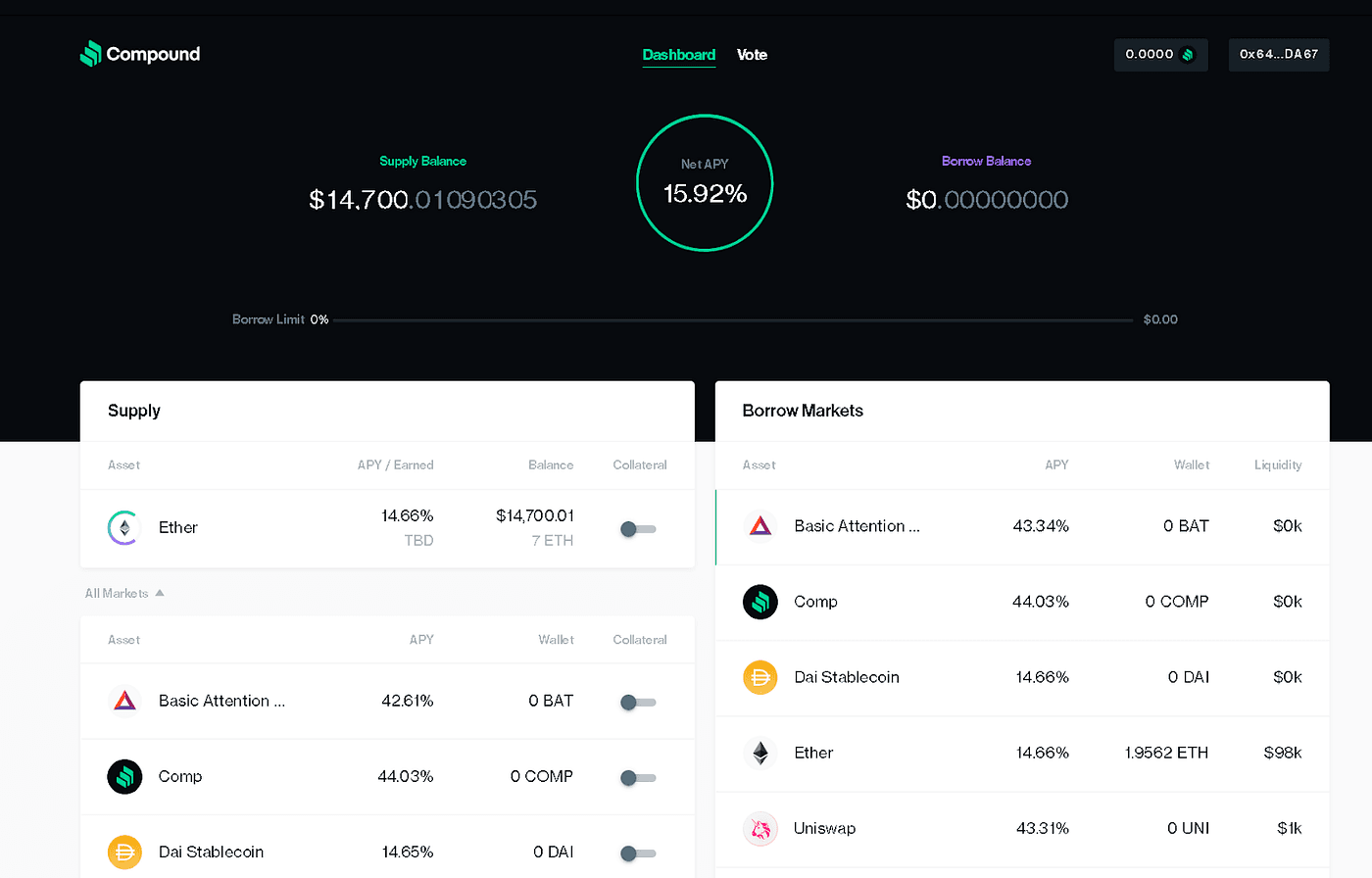

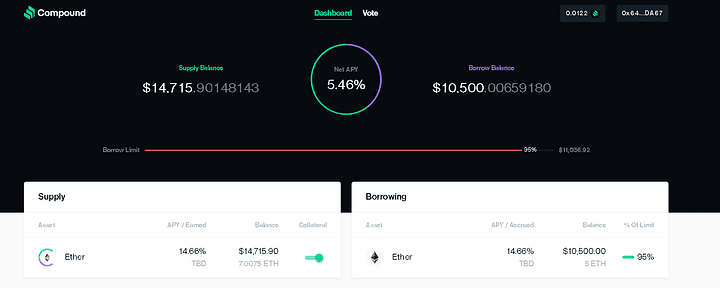

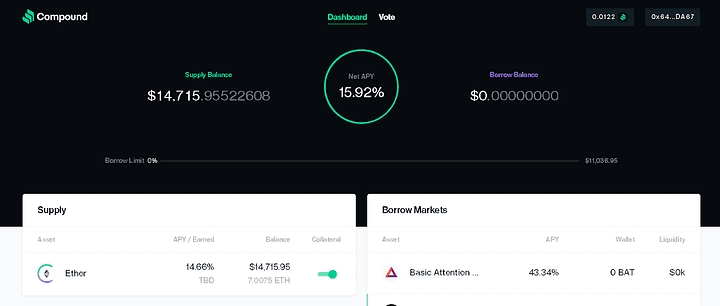

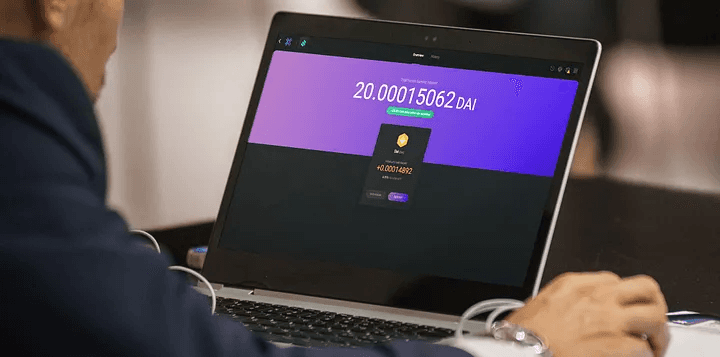

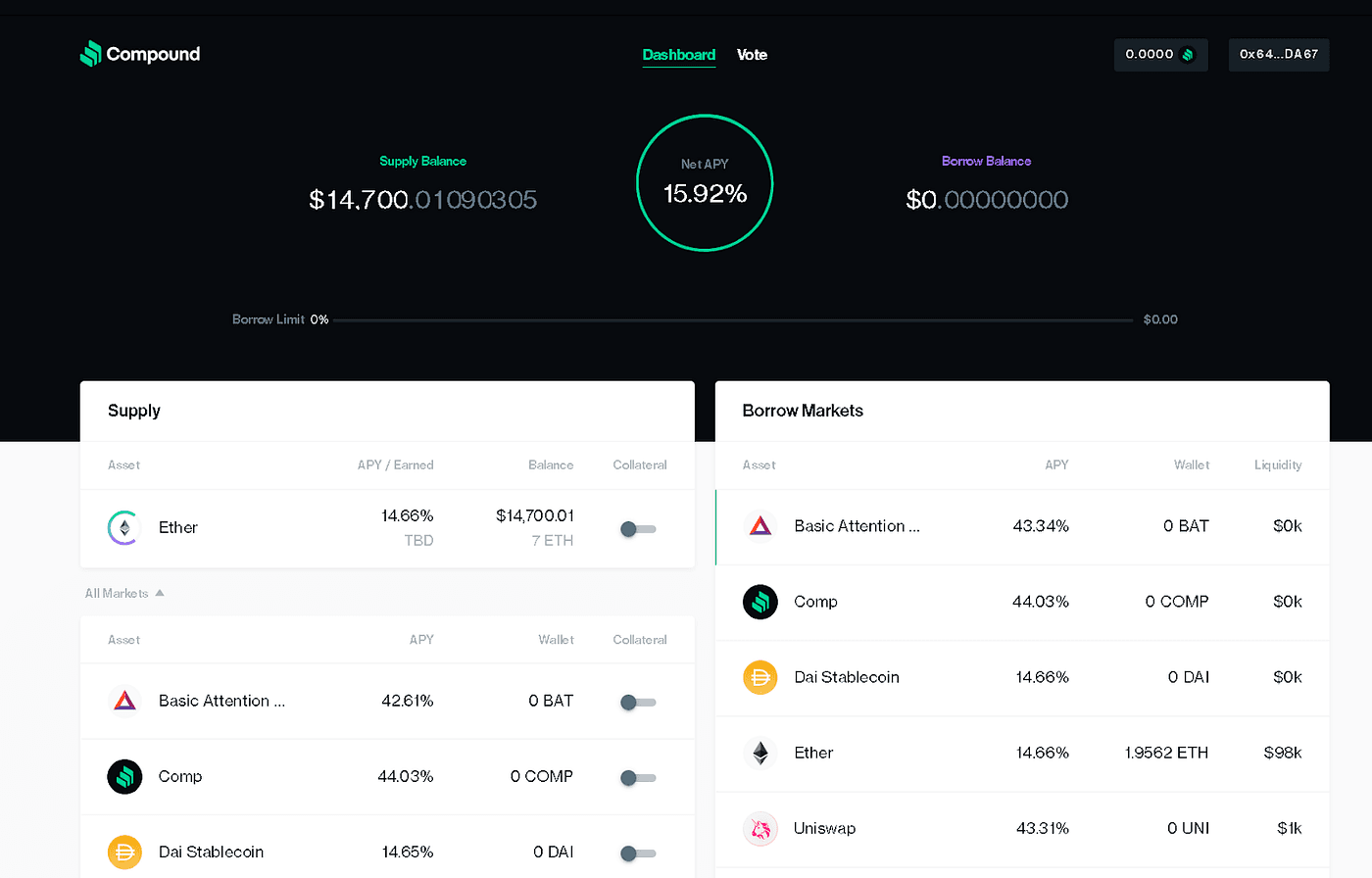

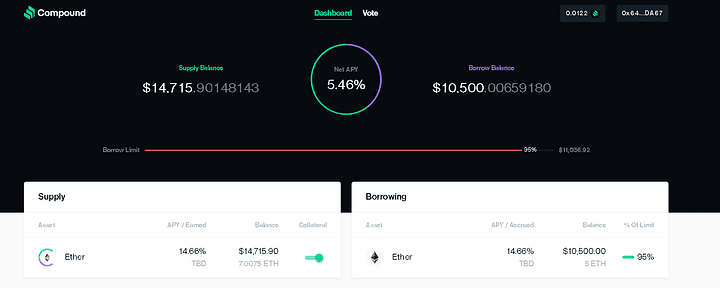

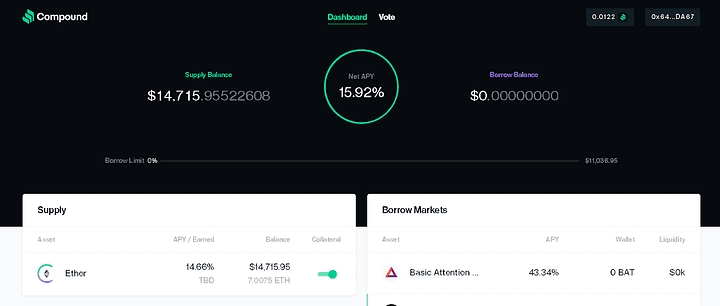

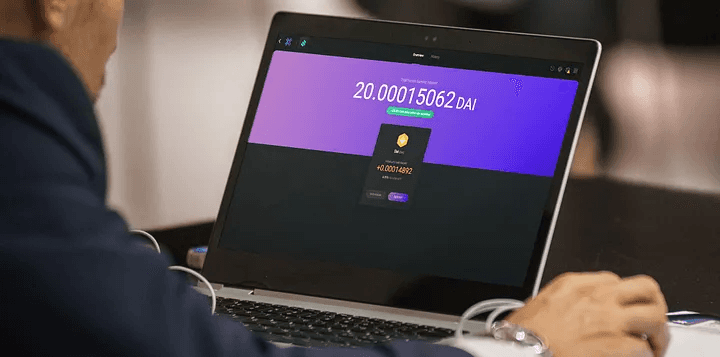

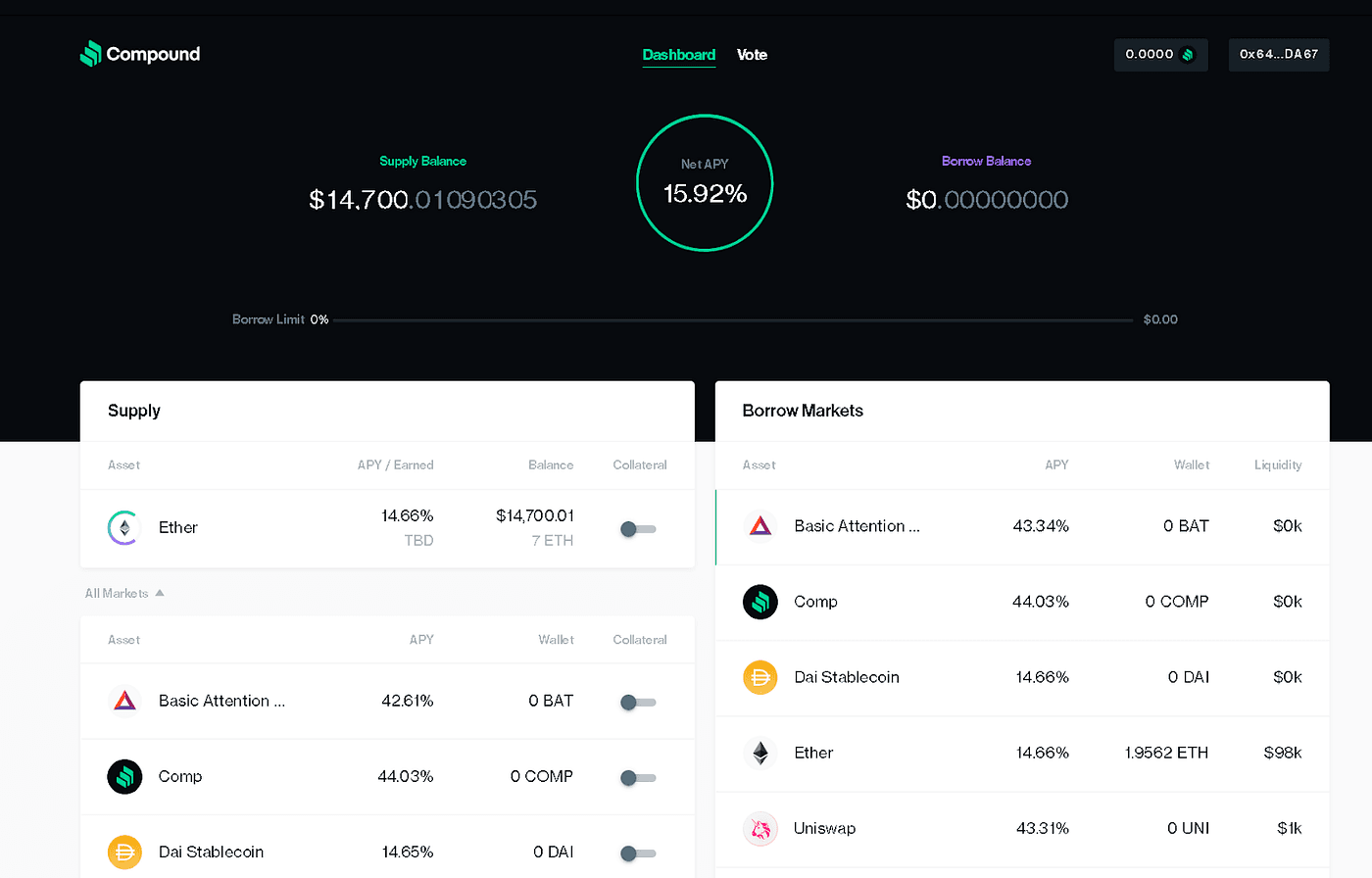

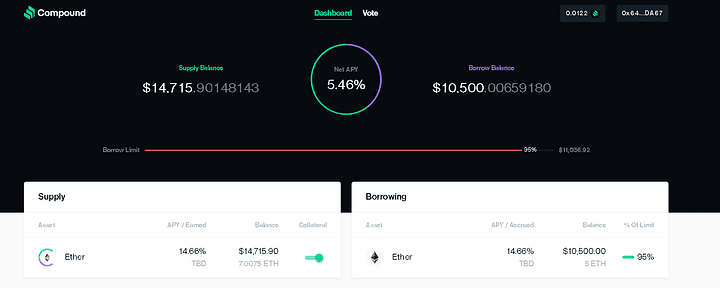

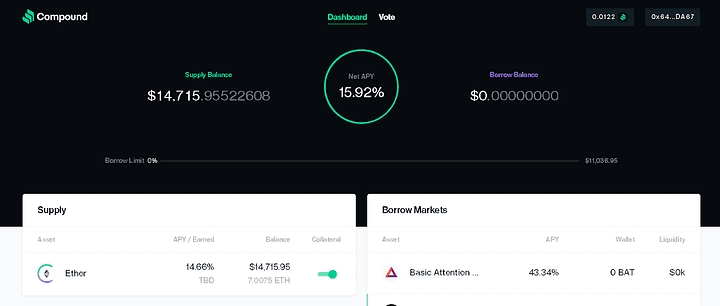

5. After your transaction is validated, you may see the interest being added to your supply balance in real time.

Dashboard

6. Then we must enable an asset we own as collateral to borrow from the Borrow Markets.

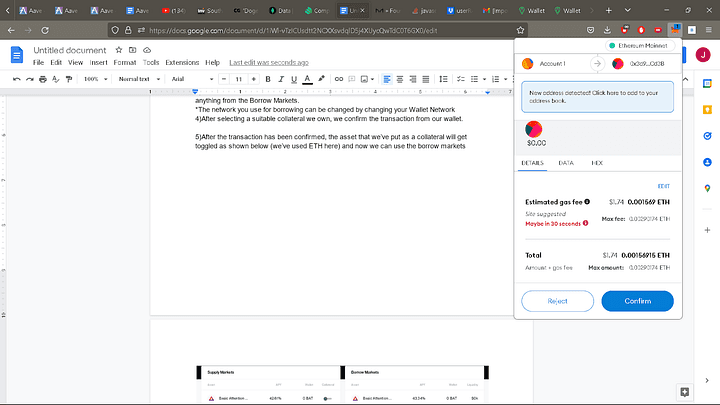

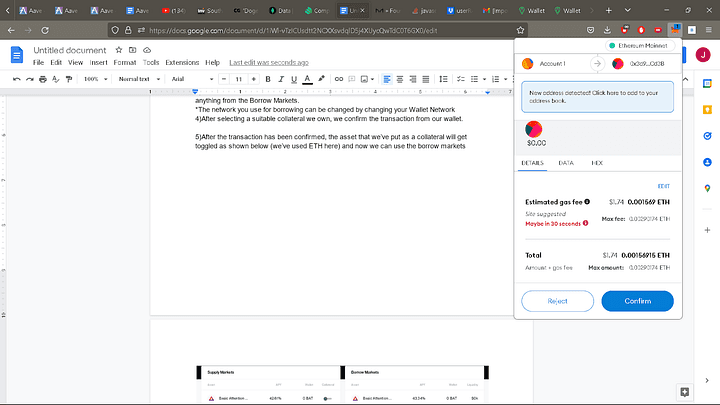

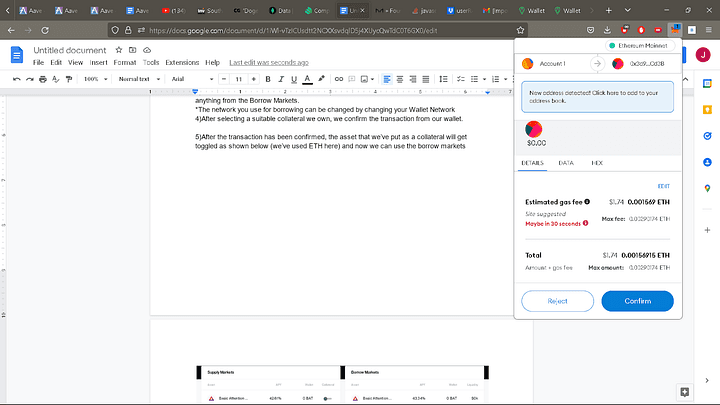

7. We confirm the transaction by paying a little gas cost from our wallet after picking the appropriate collateral.

Transaction to be confirmed

8. After the transaction has been verified, the asset that we’ve used as collateral will be toggled as shown below (we’ve used ETH here) and now we may use the borrow markets.

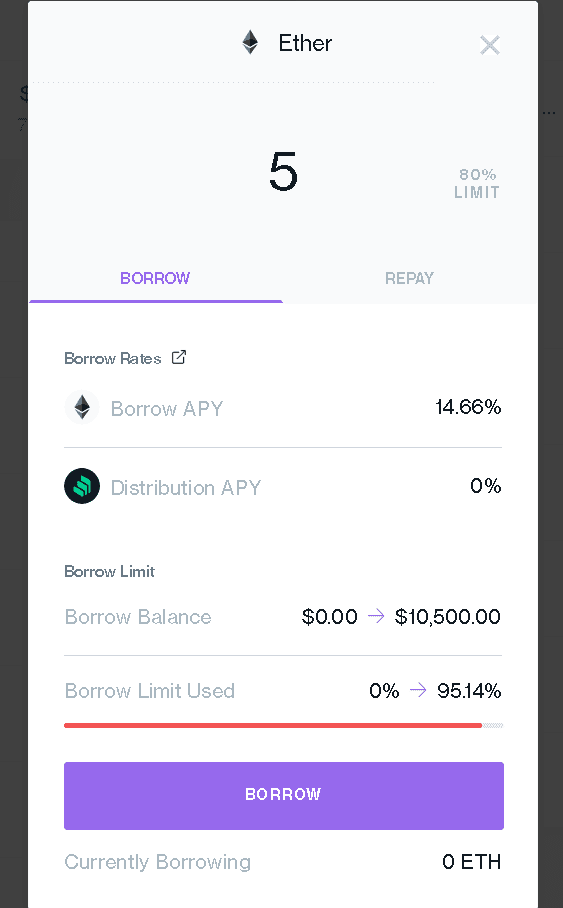

Assets in the Borrow Markets

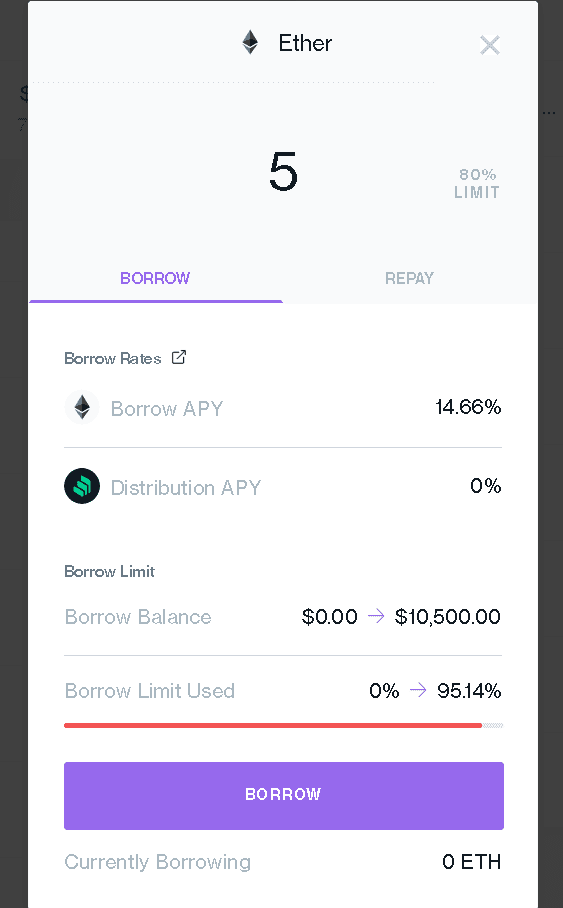

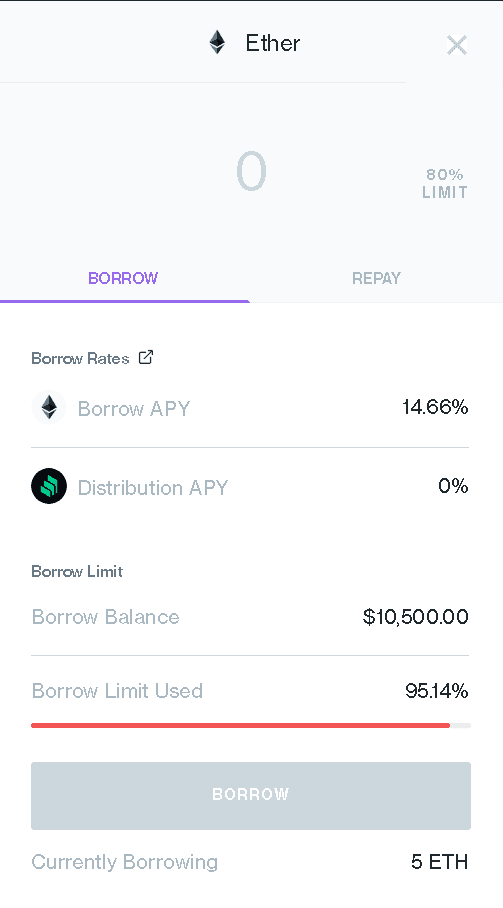

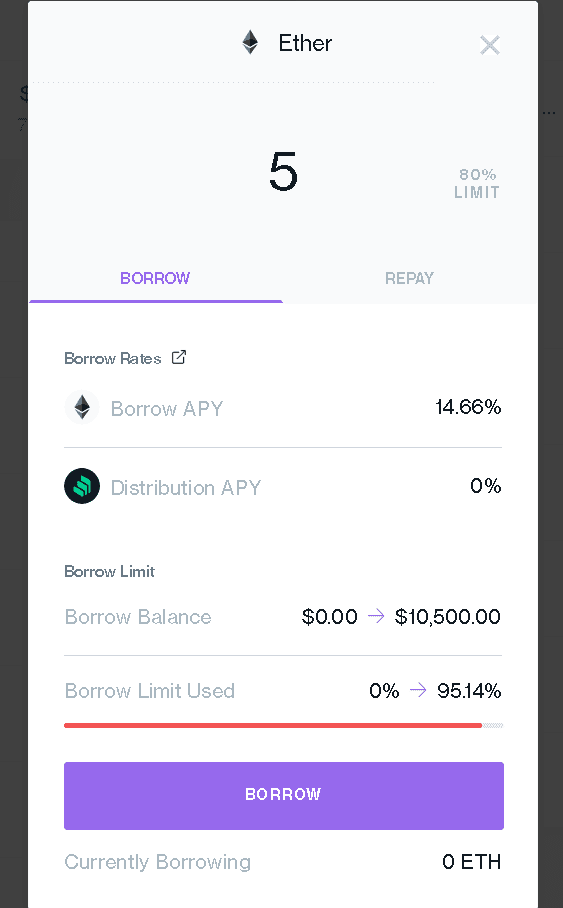

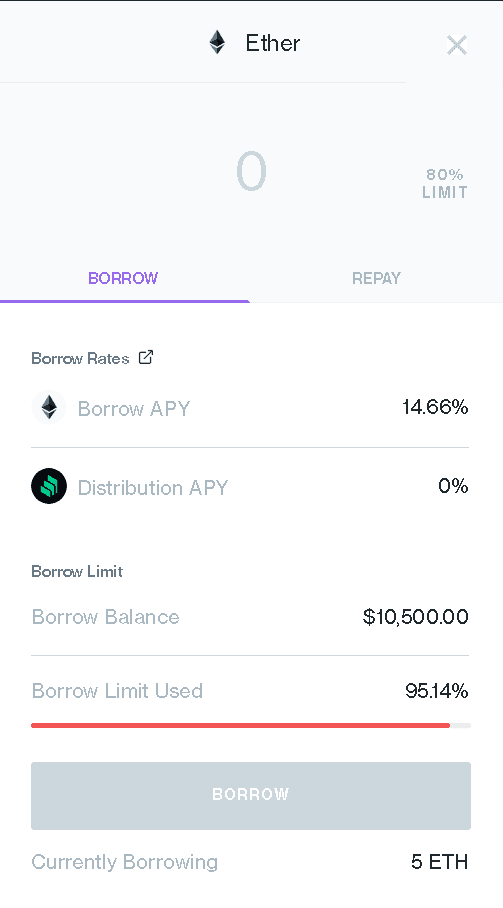

9. Then we may borrow any asset from the borrow markets but take care you’ll have to return the loan together with the interest rate (represented in APY).

We chose Ether as an asset

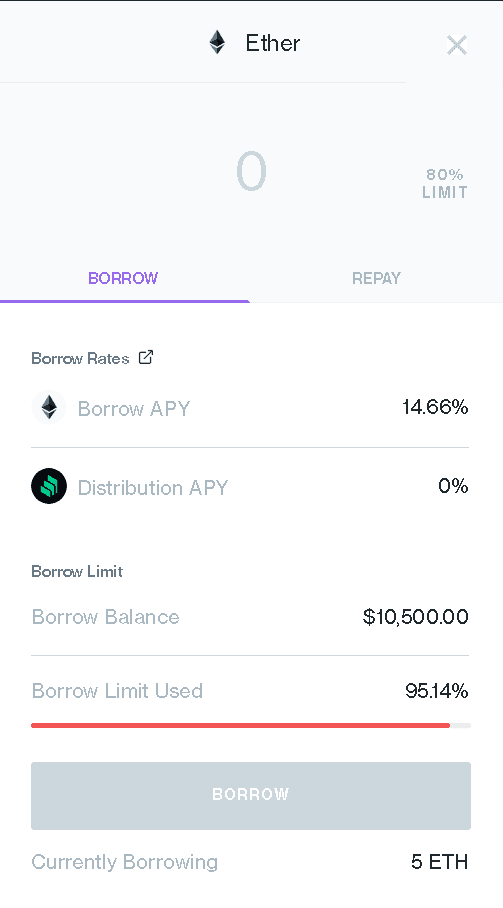

10. After the transaction is finalized, the borrowed tokens will be shown in your Wallet balance as well as presently borrowing. You’ll also be able to check Net APY.

Tokens are transferred to your Wallet

Dashboard after borrowing some assets

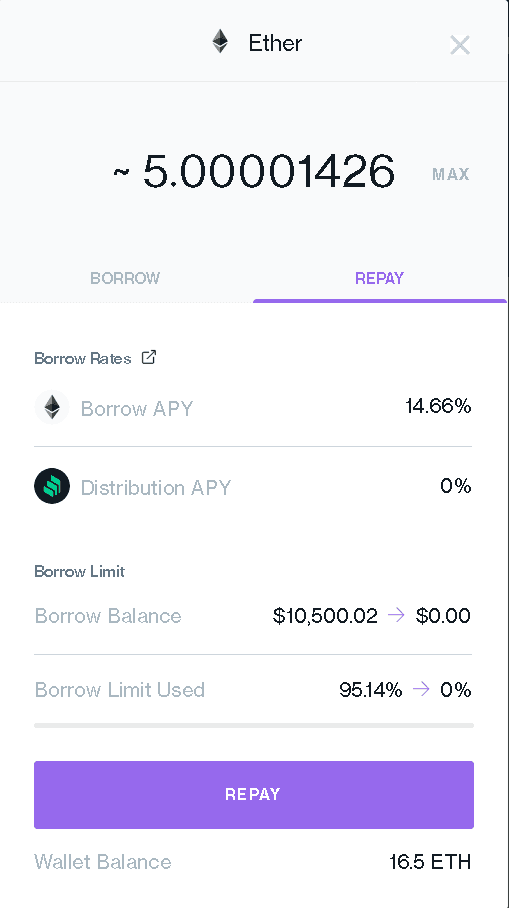

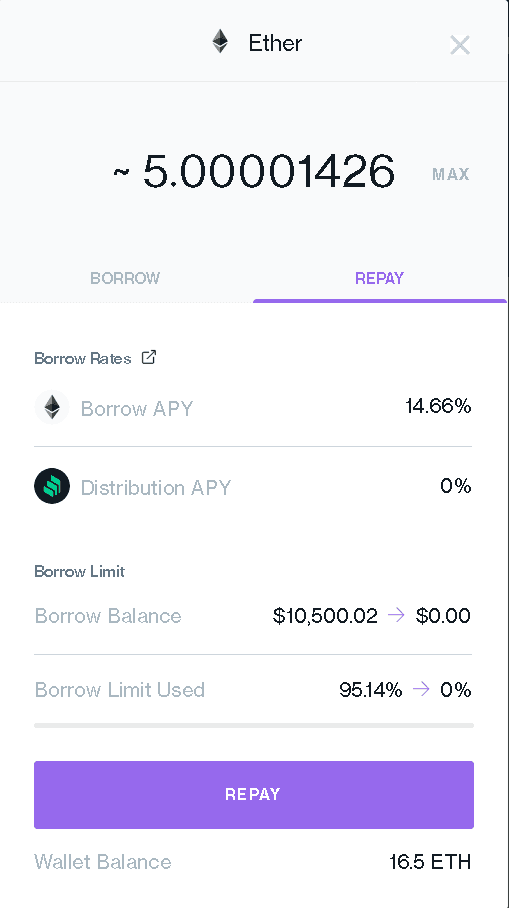

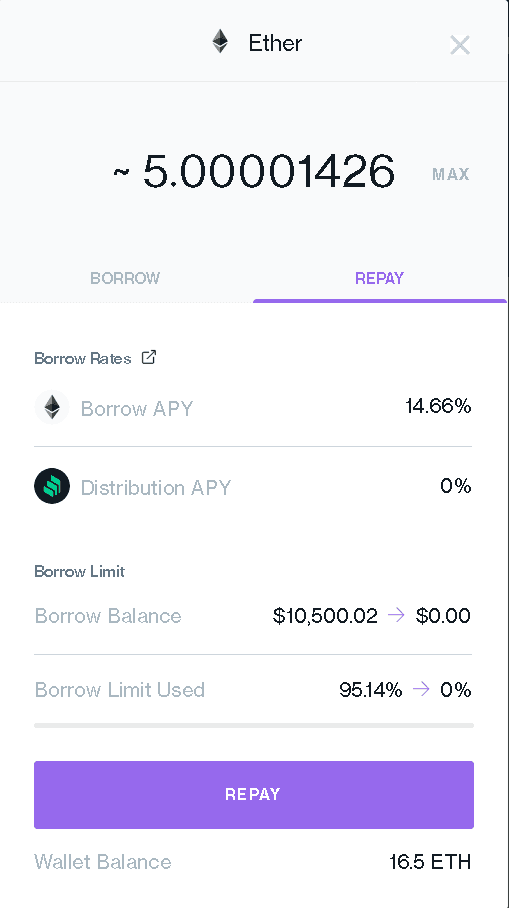

11. After the borrowing procedure is completed, we must repay our borrowed assets after we have finished utilizing them. So, we proceed to the Repay tab after clicking on the asset in the borrowing division.

And here we may select the amount we want to repay, or we can click the max option to pay the entire amount of our loan. When we opt to refund the entire amount, the interest will be charged to it.

To repay the borrowed Assets

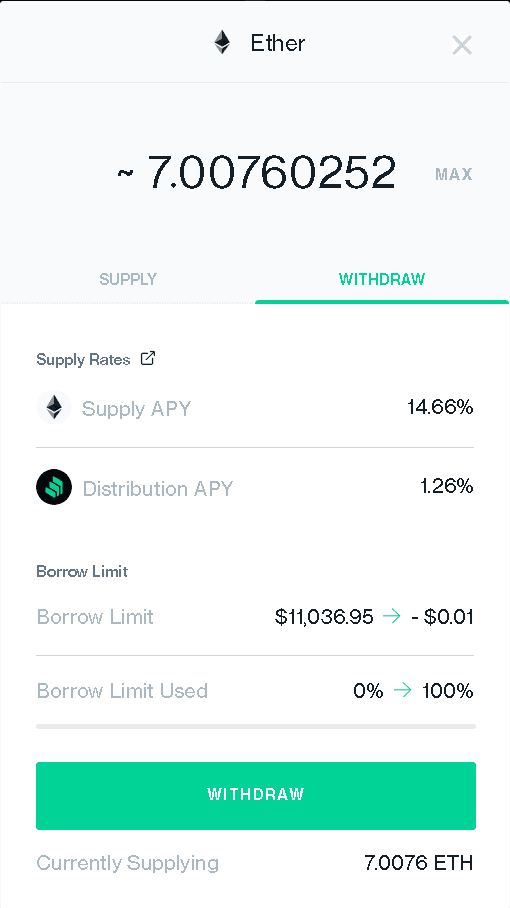

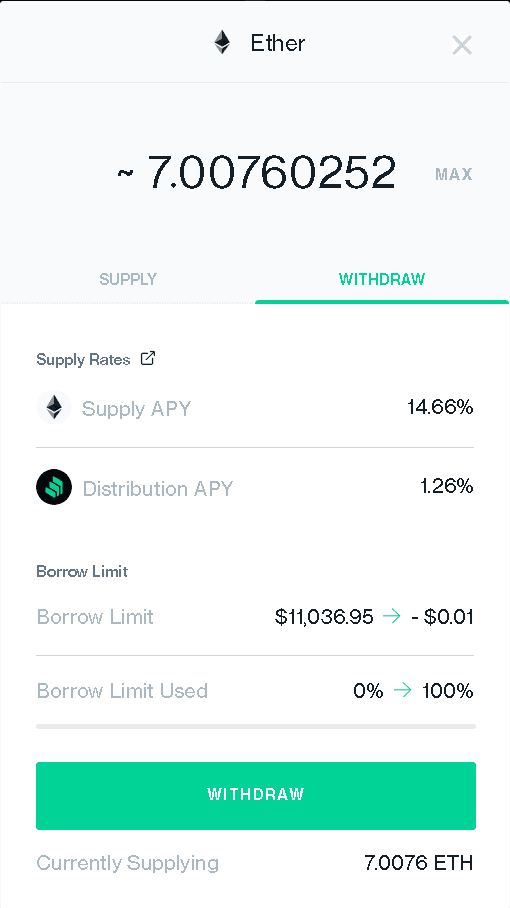

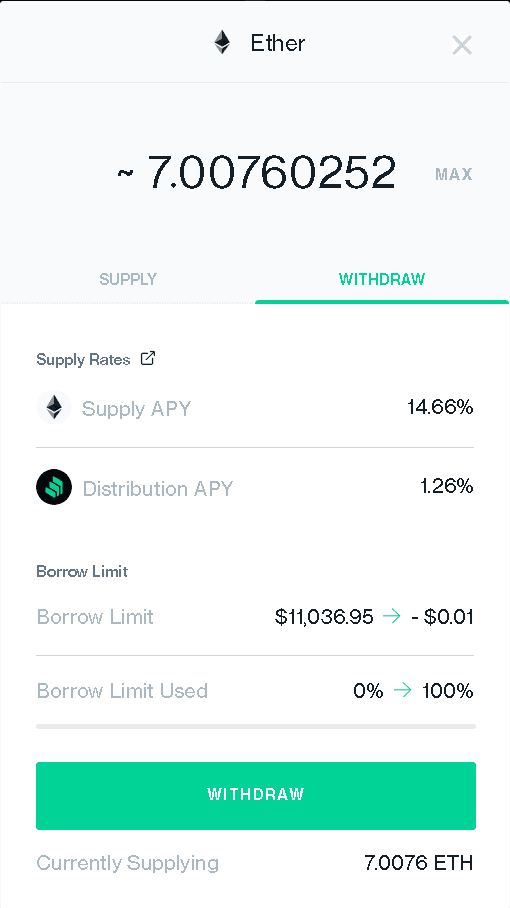

12. Now we may withdraw our original supply asset if we desire to, or we can continue getting interest on our provided asset. We withdraw the asset by clicking on it in the supply.

Dashboard

13. Then we go to the withdraw tab, enter the amount we wish to withdraw, or to withdraw all our supplied amount with the interest it has accumulated, we click on max. Following that, we will repeat the procedure of verifying our purchase.

If the customer wants to Withdraw the interest he or got

Finally, you’ve established your Compound account!! This was a preview of how to develop and deal with Finance using Compound. I hope you find this educational enough to get to know about finances and compounds.

I hope this article was informative and provided you with the details you required. If you have any questions while reading the blog, message me on Instagram or LinkedIn. For any kind of work for DeFi , Smart Contract Development ,Blockchain Development you can contact me at helpmeanubhav@gmail.com .Special credits to my team member: Krisha Amlani

Thank You…

Contents:

Introduction

Create an Account on Compound

Connect Wallet

Borrow Any Asset

Transaction Confirmed

Repay and Withdrawal

Banking, budgeting, saving, credit, debt, and investing are the foundations that support the majority of our financial decisions. And having all the required basic knowledge of these things is a must.

Financial literacy is the ability to understand and make use of a variety of financial skills, including personal financial management, budgeting, and investing. It also means comprehending certain financial principles and concepts, such as the time value of money, compound interest, managing debt, and financial planning.

Through this blog, you will get to know about Compound, an online financial marketplace that will assist everyone to deal with lending, borrowing, and other financial services utilising cryptos.

Compound finance is a type of online financial marketplace that allows users to lend and borrow digital assets. Now let’s get started with compound by creating an account.

Follow the below steps: -

Visit the given link.

https://compound.finance/

Compound

The compound is an algorithmic, autonomous interest rate protocol built for developers, to unlock a universe of the open…

compound. finance

2. Connect your Meta mask/Ledger/Wallet Connect/Coinbase Wallet or Tally wallet by clicking the App Button in the upper right-hand corner.

Connect your Wallet

3. After connecting our Wallet, we may supply any Asset and receive interest on our given asset, which is represented by APY (Annual Percentage Yield). To provide any asset, we click on the desired asset and enter the amount we wish to supply.

Start Supplying Assets

4. If I supply 7ETH here, you don’t need to worry about the Borrow Limit; simply enter the number of assets you want to supply and click the Supply button. This will send you to your wallet to confirm the transaction.

5. After your transaction is validated, you may see the interest being added to your supply balance in real time.

Dashboard

6. Then we must enable an asset we own as collateral to borrow from the Borrow Markets.

7. We confirm the transaction by paying a little gas cost from our wallet after picking the appropriate collateral.

Transaction to be confirmed

8. After the transaction has been verified, the asset that we’ve used as collateral will be toggled as shown below (we’ve used ETH here) and now we may use the borrow markets.

Assets in the Borrow Markets

9. Then we may borrow any asset from the borrow markets but take care you’ll have to return the loan together with the interest rate (represented in APY).

We chose Ether as an asset

10. After the transaction is finalized, the borrowed tokens will be shown in your Wallet balance as well as presently borrowing. You’ll also be able to check Net APY.

Tokens are transferred to your Wallet

Dashboard after borrowing some assets

11. After the borrowing procedure is completed, we must repay our borrowed assets after we have finished utilizing them. So, we proceed to the Repay tab after clicking on the asset in the borrowing division.

And here we may select the amount we want to repay, or we can click the max option to pay the entire amount of our loan. When we opt to refund the entire amount, the interest will be charged to it.

To repay the borrowed Assets

12. Now we may withdraw our original supply asset if we desire to, or we can continue getting interest on our provided asset. We withdraw the asset by clicking on it in the supply.

Dashboard

13. Then we go to the withdraw tab, enter the amount we wish to withdraw, or to withdraw all our supplied amount with the interest it has accumulated, we click on max. Following that, we will repeat the procedure of verifying our purchase.

If the customer wants to Withdraw the interest he or got

Finally, you’ve established your Compound account!! This was a preview of how to develop and deal with Finance using Compound. I hope you find this educational enough to get to know about finances and compounds.

I hope this article was informative and provided you with the details you required. If you have any questions while reading the blog, message me on Instagram or LinkedIn. For any kind of work for DeFi , Smart Contract Development ,Blockchain Development you can contact me at helpmeanubhav@gmail.com .Special credits to my team member: Krisha Amlani

Thank You…

Contents:

Introduction

Create an Account on Compound

Connect Wallet

Borrow Any Asset

Transaction Confirmed

Repay and Withdrawal

Banking, budgeting, saving, credit, debt, and investing are the foundations that support the majority of our financial decisions. And having all the required basic knowledge of these things is a must.

Financial literacy is the ability to understand and make use of a variety of financial skills, including personal financial management, budgeting, and investing. It also means comprehending certain financial principles and concepts, such as the time value of money, compound interest, managing debt, and financial planning.

Through this blog, you will get to know about Compound, an online financial marketplace that will assist everyone to deal with lending, borrowing, and other financial services utilising cryptos.

Compound finance is a type of online financial marketplace that allows users to lend and borrow digital assets. Now let’s get started with compound by creating an account.

Follow the below steps: -

Visit the given link.

https://compound.finance/

Compound

The compound is an algorithmic, autonomous interest rate protocol built for developers, to unlock a universe of the open…

compound. finance

2. Connect your Meta mask/Ledger/Wallet Connect/Coinbase Wallet or Tally wallet by clicking the App Button in the upper right-hand corner.

Connect your Wallet

3. After connecting our Wallet, we may supply any Asset and receive interest on our given asset, which is represented by APY (Annual Percentage Yield). To provide any asset, we click on the desired asset and enter the amount we wish to supply.

Start Supplying Assets

4. If I supply 7ETH here, you don’t need to worry about the Borrow Limit; simply enter the number of assets you want to supply and click the Supply button. This will send you to your wallet to confirm the transaction.

5. After your transaction is validated, you may see the interest being added to your supply balance in real time.

Dashboard

6. Then we must enable an asset we own as collateral to borrow from the Borrow Markets.

7. We confirm the transaction by paying a little gas cost from our wallet after picking the appropriate collateral.

Transaction to be confirmed

8. After the transaction has been verified, the asset that we’ve used as collateral will be toggled as shown below (we’ve used ETH here) and now we may use the borrow markets.

Assets in the Borrow Markets

9. Then we may borrow any asset from the borrow markets but take care you’ll have to return the loan together with the interest rate (represented in APY).

We chose Ether as an asset

10. After the transaction is finalized, the borrowed tokens will be shown in your Wallet balance as well as presently borrowing. You’ll also be able to check Net APY.

Tokens are transferred to your Wallet

Dashboard after borrowing some assets

11. After the borrowing procedure is completed, we must repay our borrowed assets after we have finished utilizing them. So, we proceed to the Repay tab after clicking on the asset in the borrowing division.

And here we may select the amount we want to repay, or we can click the max option to pay the entire amount of our loan. When we opt to refund the entire amount, the interest will be charged to it.

To repay the borrowed Assets

12. Now we may withdraw our original supply asset if we desire to, or we can continue getting interest on our provided asset. We withdraw the asset by clicking on it in the supply.

Dashboard

13. Then we go to the withdraw tab, enter the amount we wish to withdraw, or to withdraw all our supplied amount with the interest it has accumulated, we click on max. Following that, we will repeat the procedure of verifying our purchase.

If the customer wants to Withdraw the interest he or got

Finally, you’ve established your Compound account!! This was a preview of how to develop and deal with Finance using Compound. I hope you find this educational enough to get to know about finances and compounds.

I hope this article was informative and provided you with the details you required. If you have any questions while reading the blog, message me on Instagram or LinkedIn. For any kind of work for DeFi , Smart Contract Development ,Blockchain Development you can contact me at helpmeanubhav@gmail.com .Special credits to my team member: Krisha Amlani

Thank You…